BANKING

Personal Consumer Loan

OVERVIEW

Project: B2C banking, Loans

Duration: 3 mos consulting engagement

Tools/Apps: Sketch, Axure

Role: Design and Research Lead

RESPONSIBILITIES

Defined project scope and design vison

Planned and moderated Persona and Journey Mapping Workshops

Developed and finalized MVP wireframes and interactive prototype

Led collaborative design reviews with project sponsor and key stakeholders

DELIVERABLES

Stakeholder and User Interviews Key Findings

Competitive Review and Best Practices

Current and future state Journey Maps

Responsive UX design (wireframes)

Interactive Prototype

Visual Design Assets

NOTE: The content in this project has been scrubbed or altered due to Client NDA.

OBJECTIVES

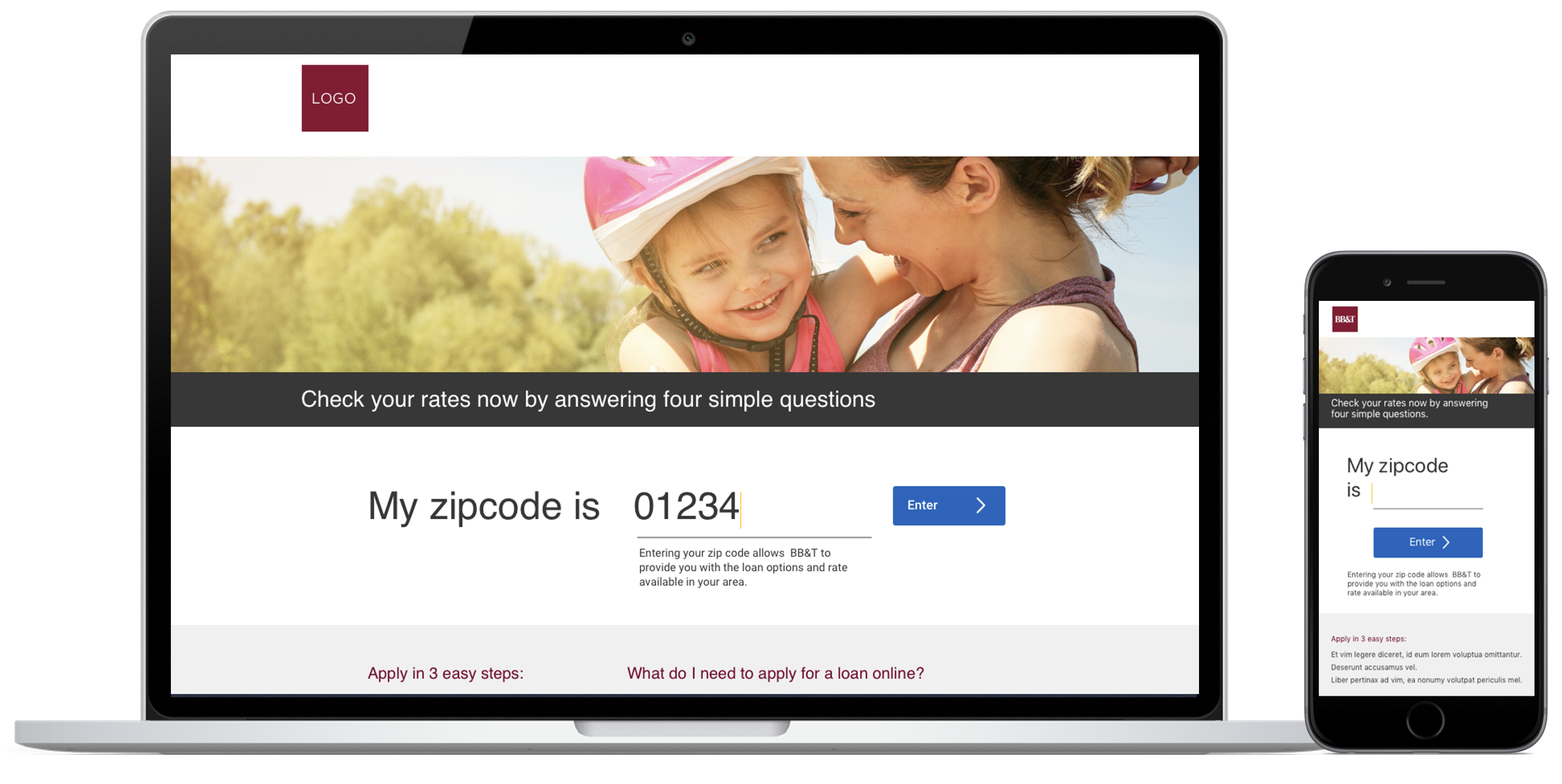

Offer customers the ability to apply for, track and get approval for Personal Unsecured and Line of Credit loans online via the bank website instead of having to go into a bank branch

Provide fully responsive and consistent branded customer experience across mobile and desktop form factors

CURRENT CHALLENGES

Customers can only apply for a personal loan in person at a local bank

Difficult to understand Personal loan details due to over use of legalese content on the website

Lack of ability to explore types of personal loans which best mets a customers financial needs and situation

Loan process and requirements are not clearly communicated up front

FRAME

Interview project stakeholders and bank loan officers to understand the problem we are trying to solve within the context of the current customer loan experience

Define personas and journey maps to identify customer needs and challenges with the current loan experience and identify opportunities for improvement

Develope the design vision and UX framework based on outcomes of a competitive analysis and research of current UX trends and best practices

PERSONAS

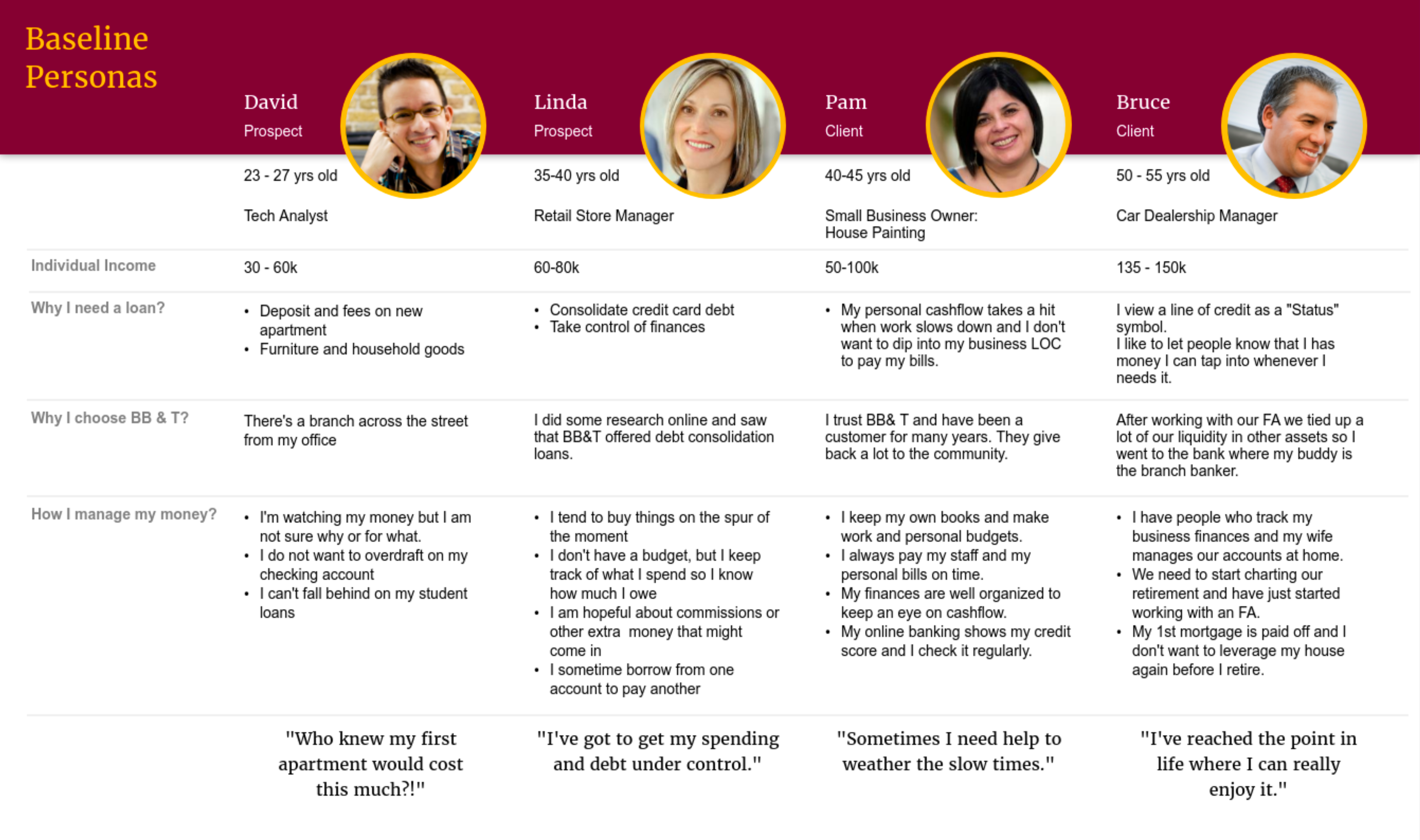

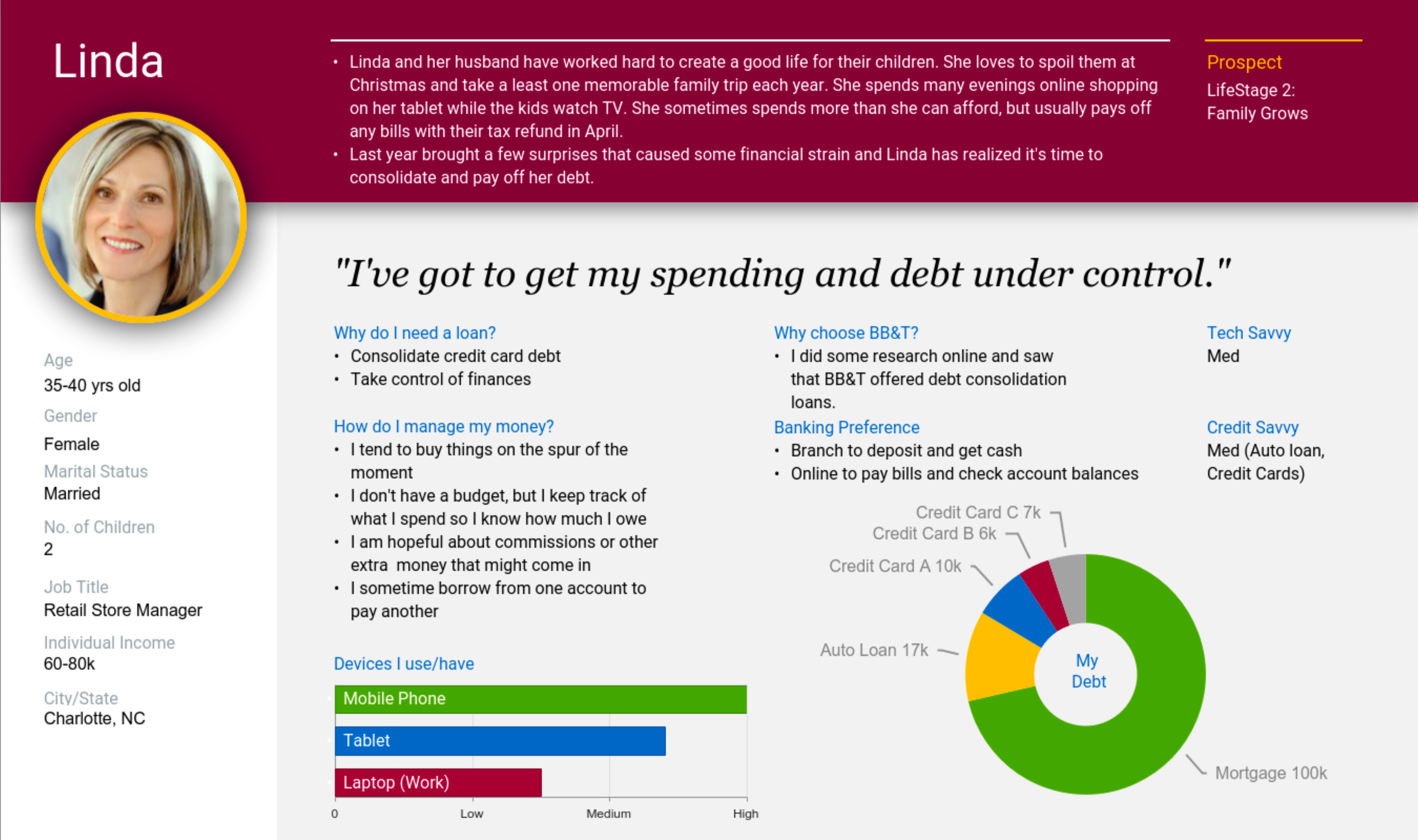

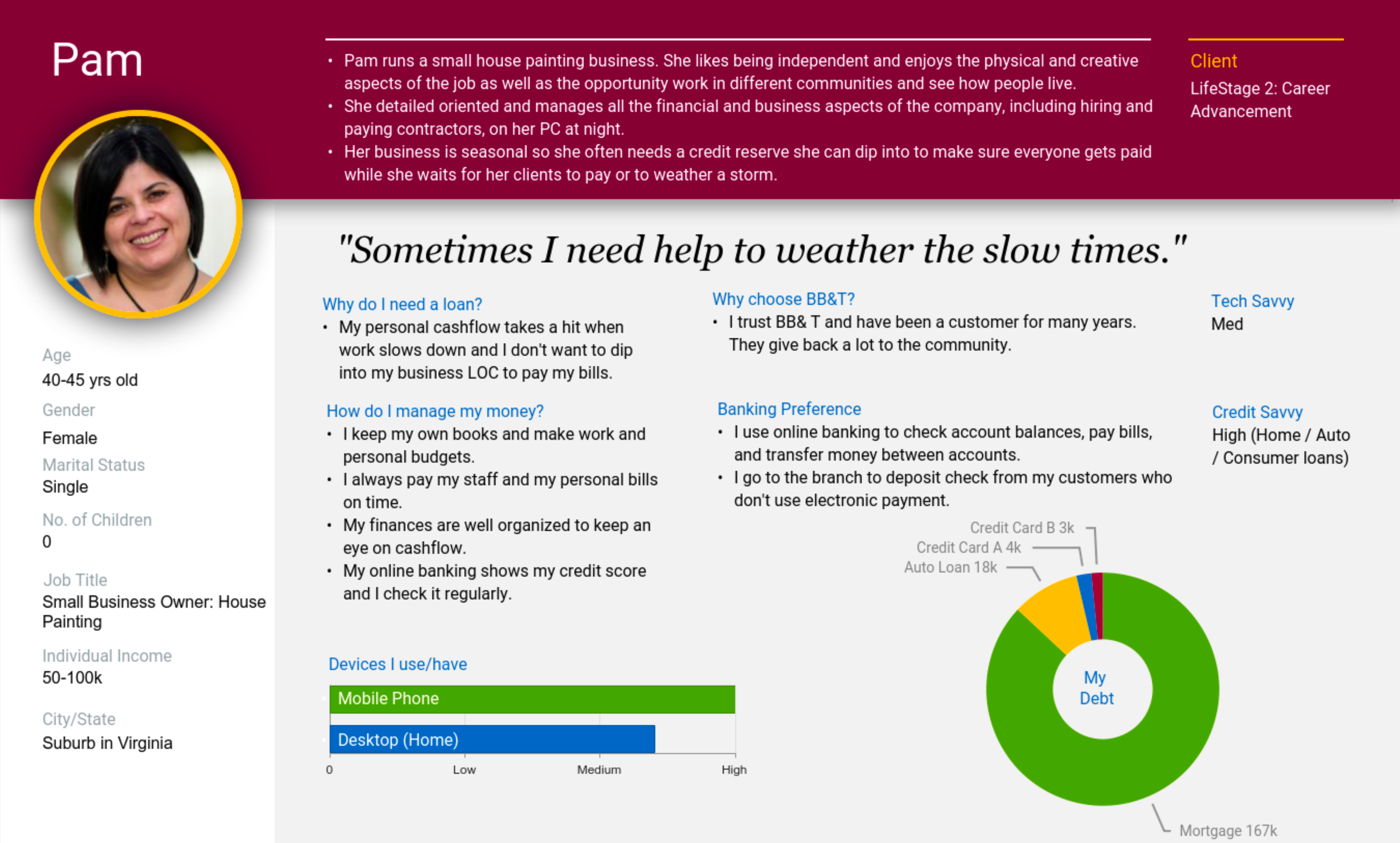

Baseline personas were defined based on the interview data to provide the product team with a foundational understanding of who we were designing for and their loan needs.

Product team selected two main personas which best represented a typical personal loan applicant.

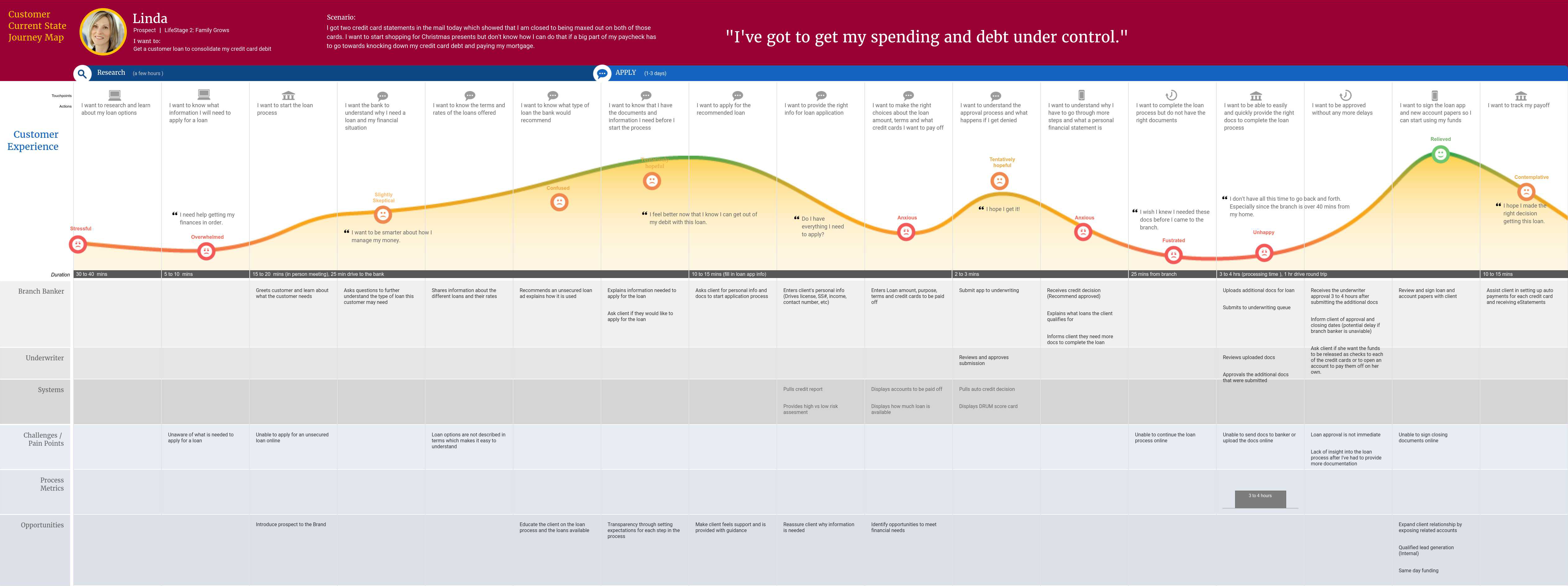

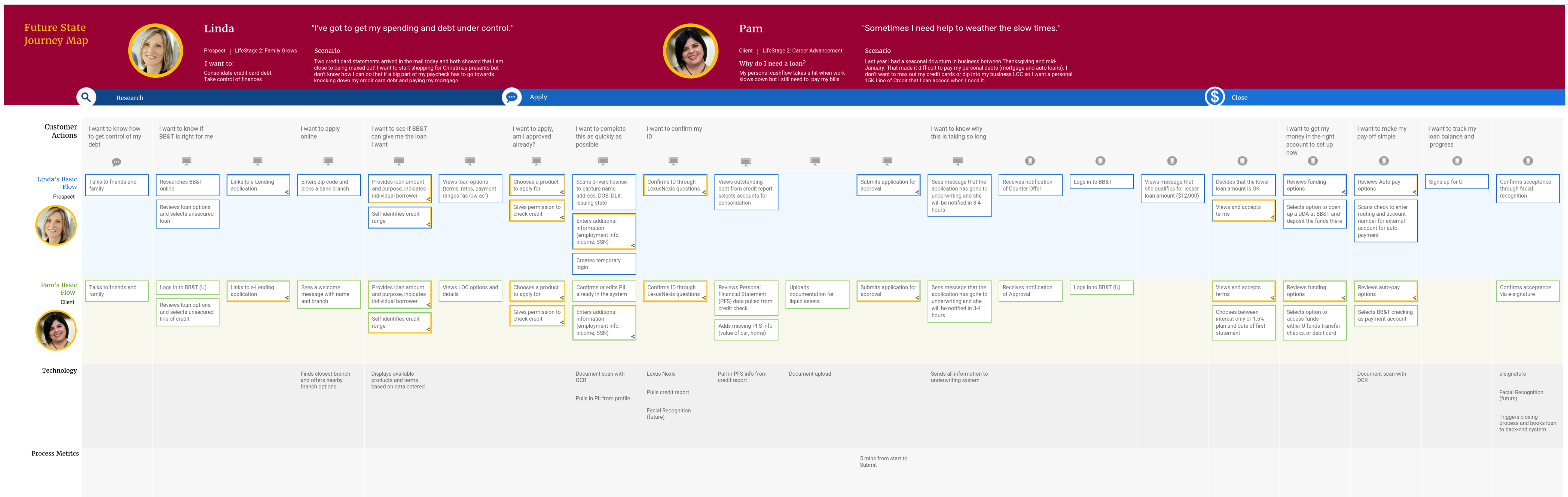

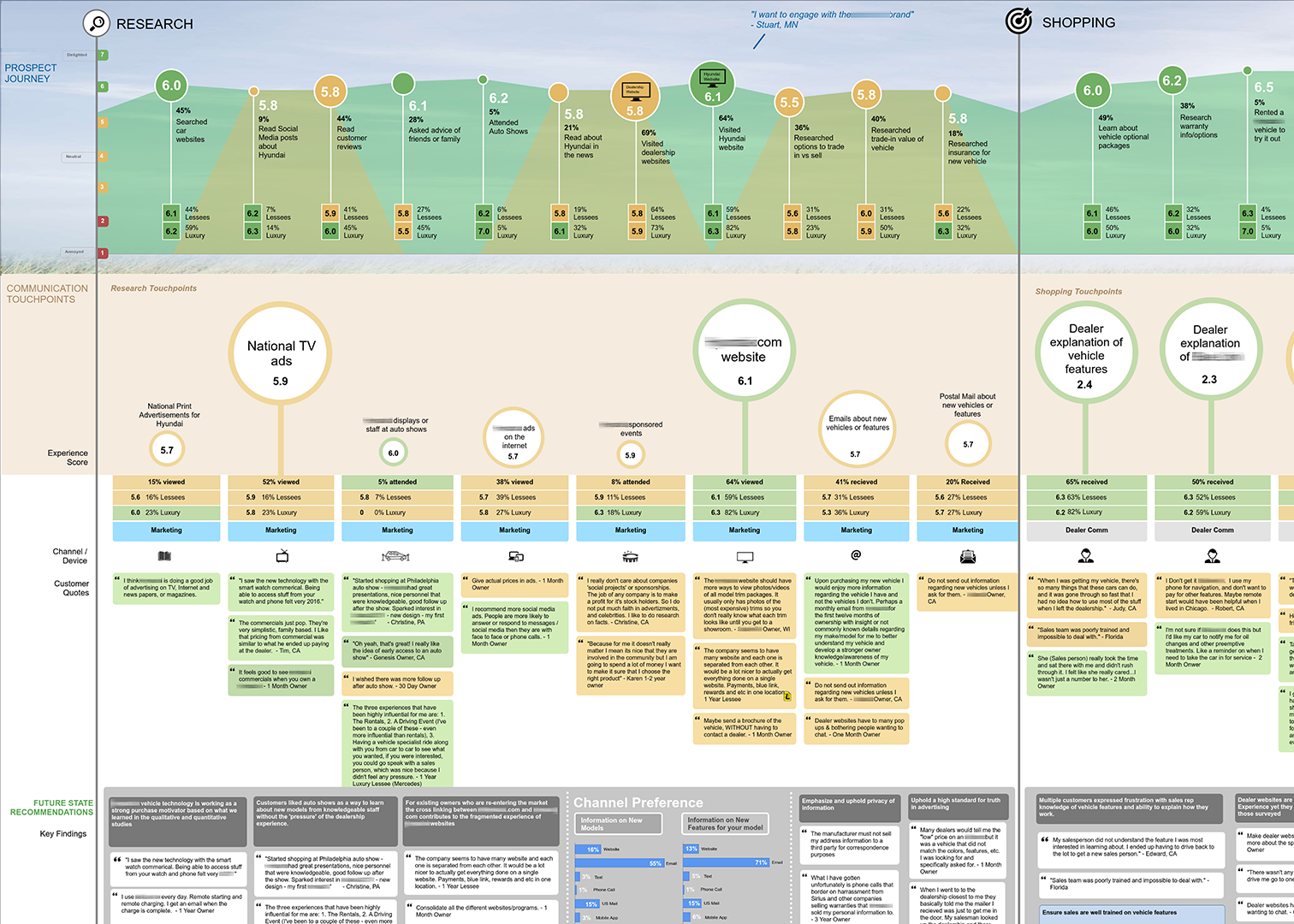

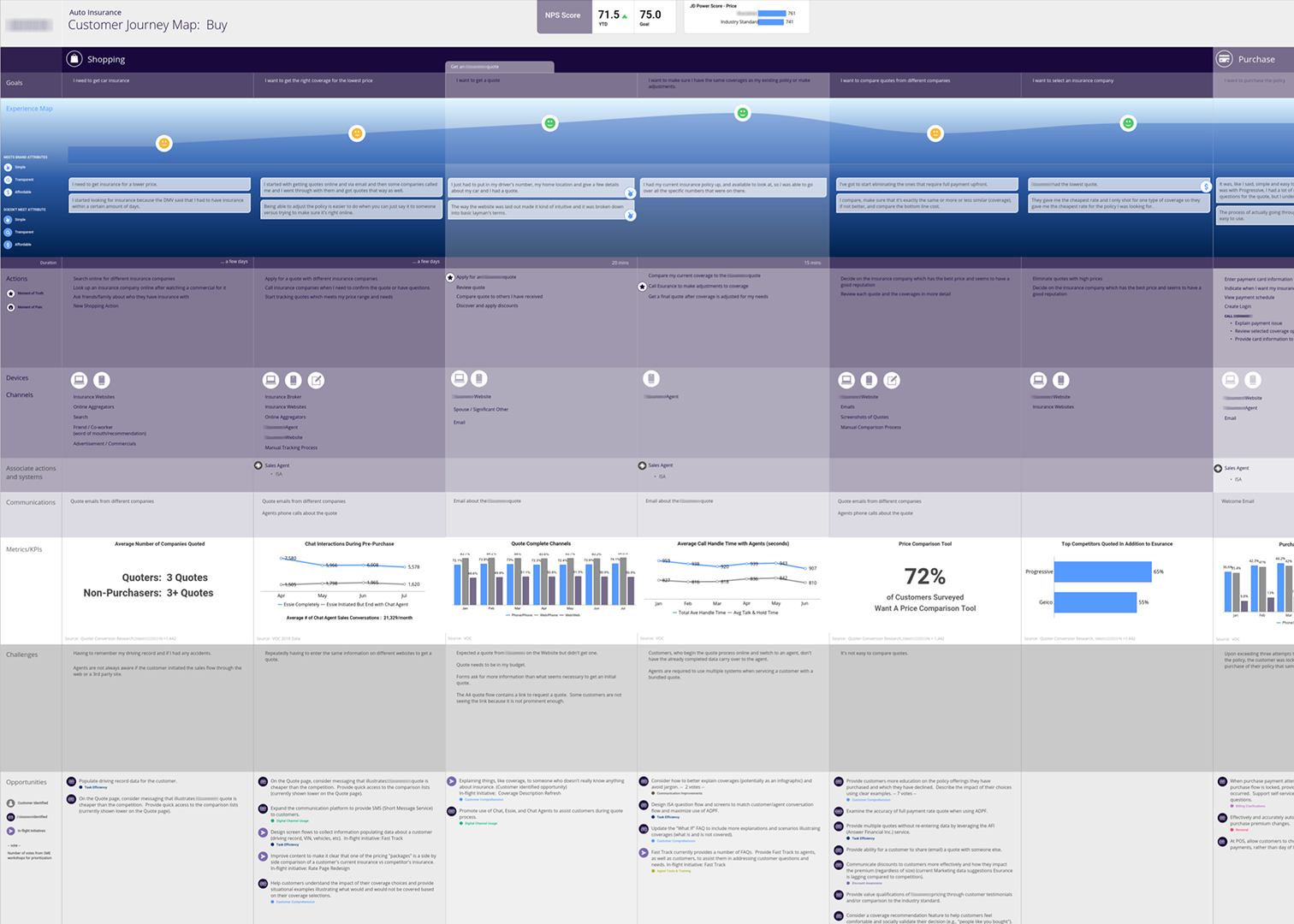

JOURNEY MAPS (Current and Future State)

Workshops were conducted with the project sponsor and product team to collaboratively visualize the current and future state of the loan experinece.

Current state journey map allowed the product team to understand the current offline experience from the customer's perspective.

Future state journey map allowed the product team to reimagine the loan application process as an online experience along with the technology needed to support it.

DESIGN

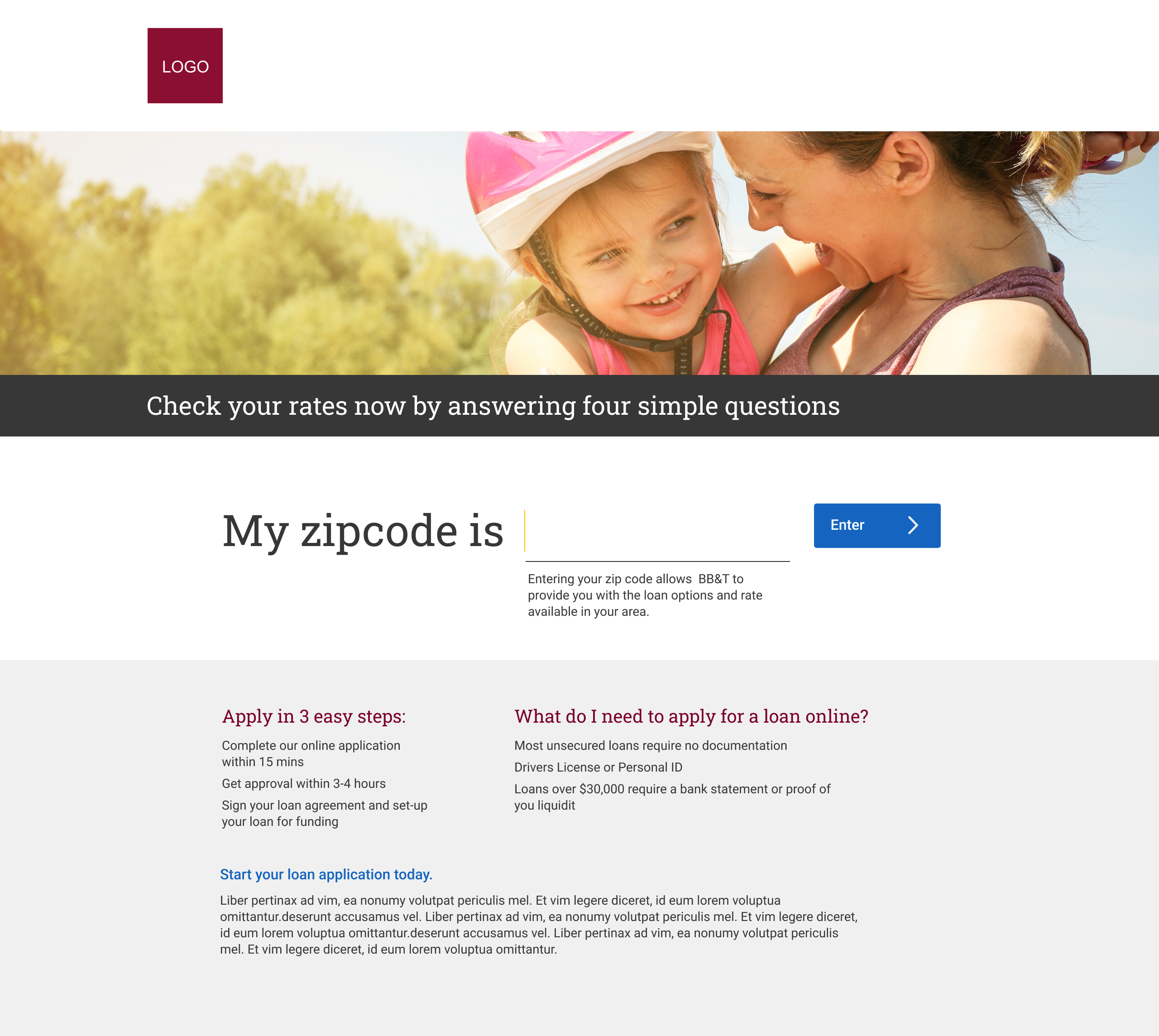

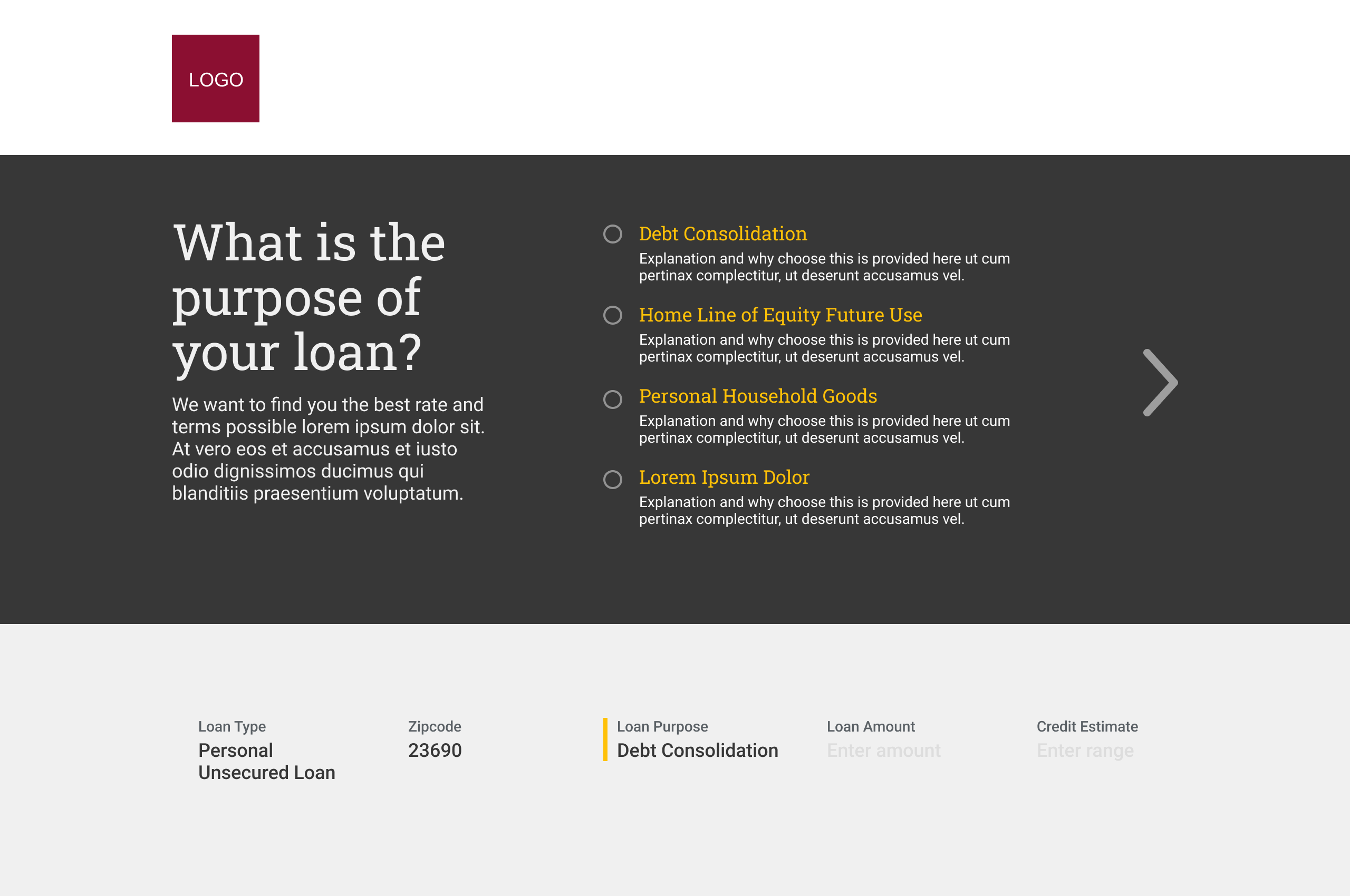

Based on the current state research and competitive analysis, we defined several key tenets which guided the design vision and defined the customer experience.

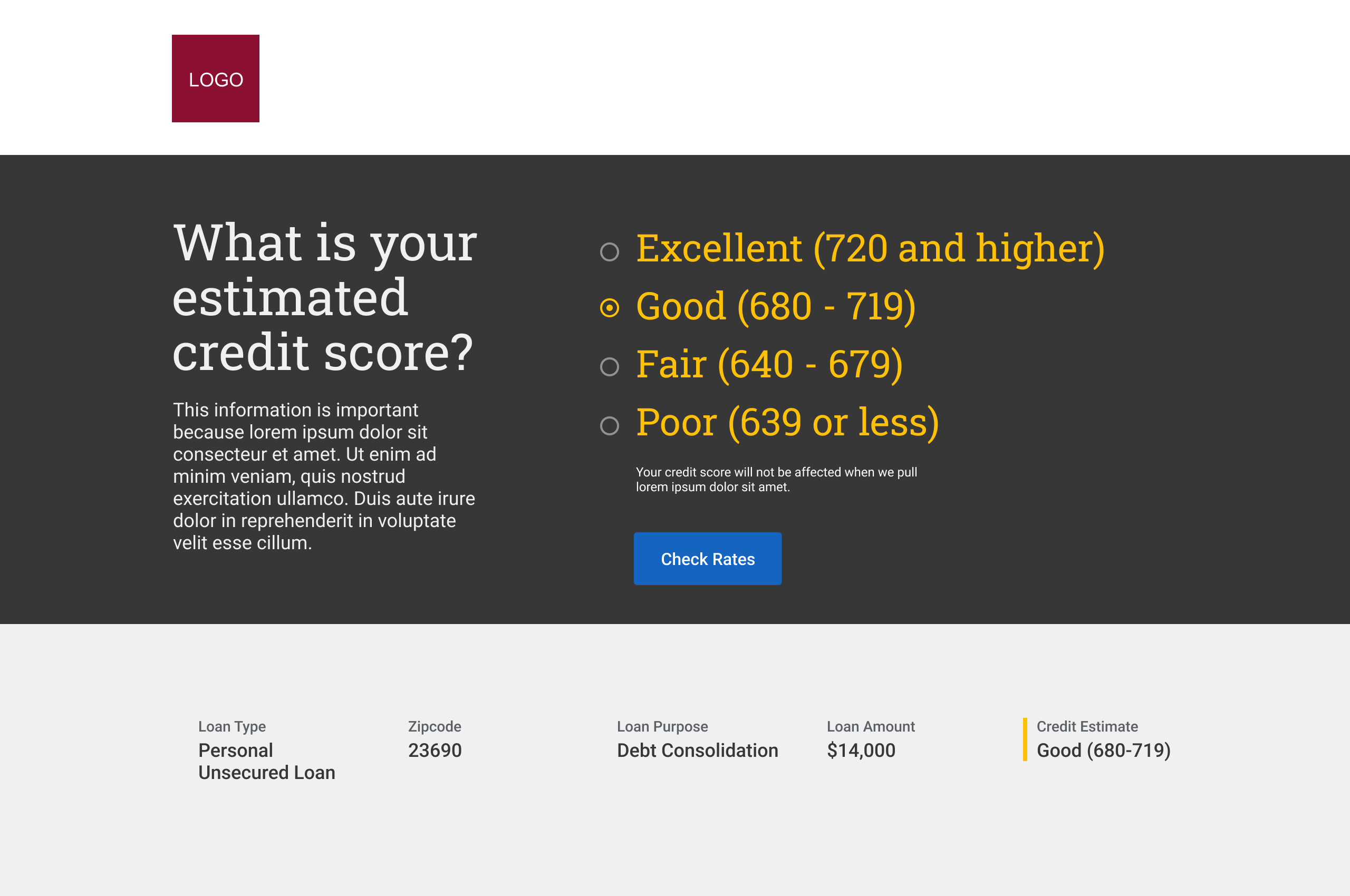

Voice and tone of the content should be conversational - as if they were speaking with a banker in person.

Online loan application experience should be simple, easy, and fast.

Provide a guided and flexible experience for successful online or offline application completion.

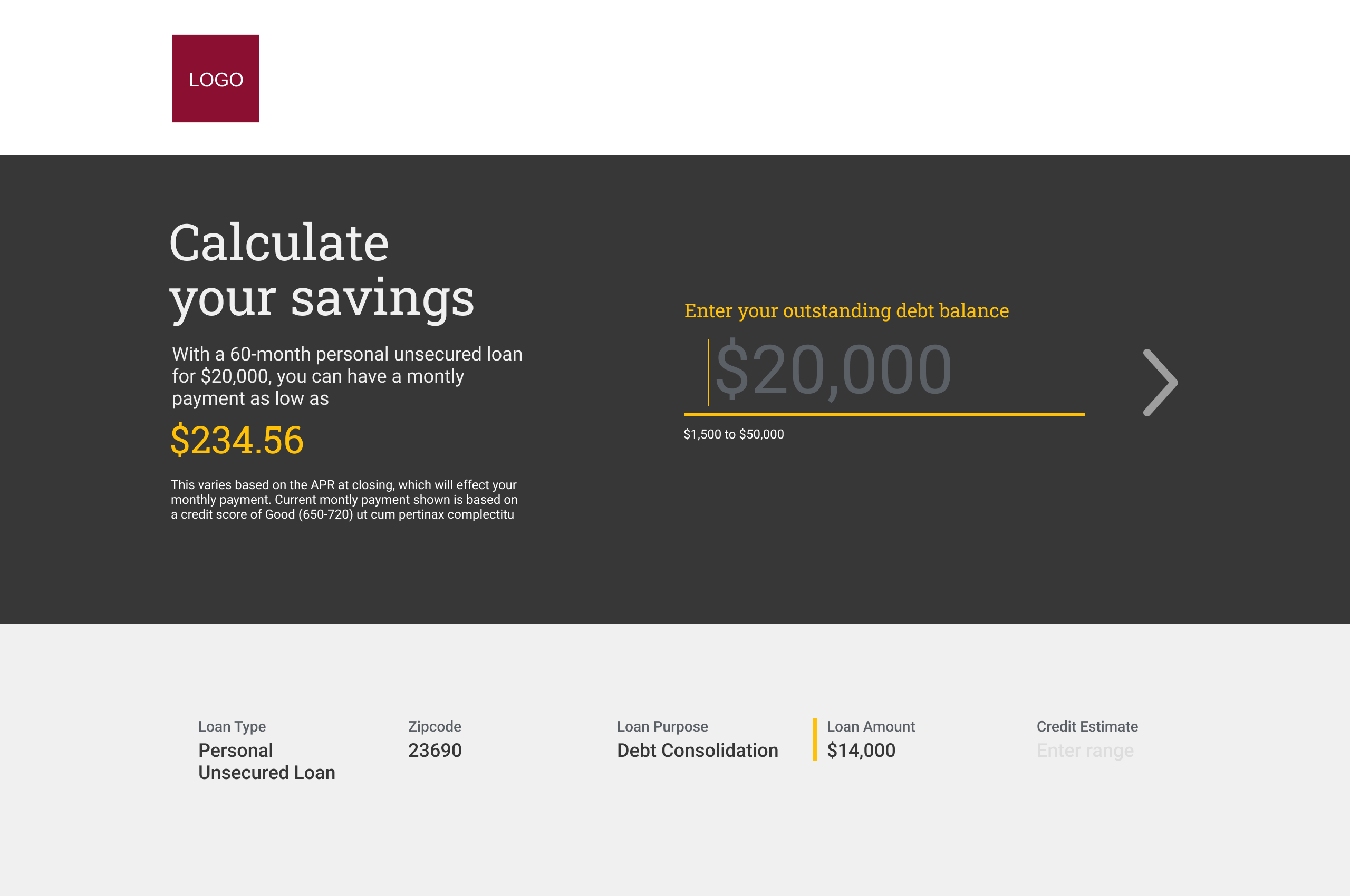

By default the website would display a customer's zipcode with the ability to change it. Based on the zipcode, additional questions based on the personal loans available in the customer's regional area.

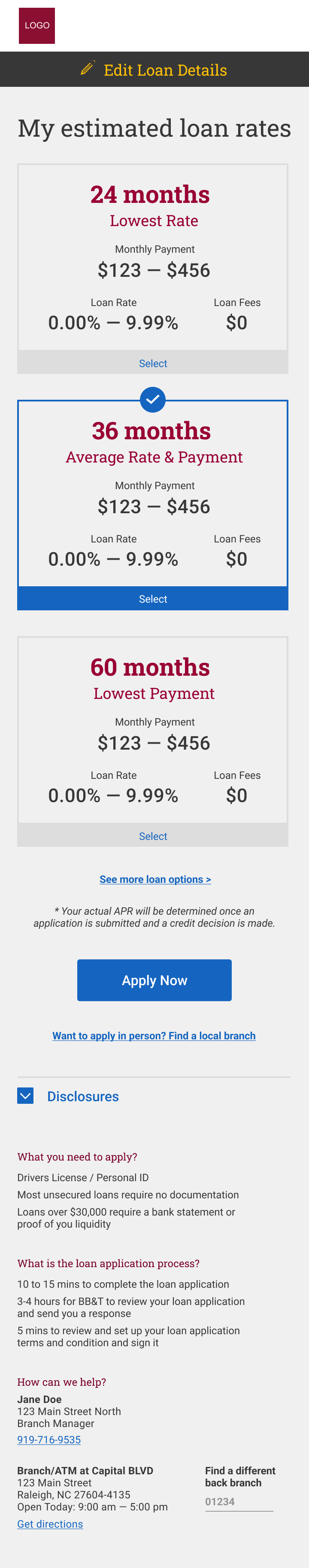

ESTIMATED LOAN OPTIONS

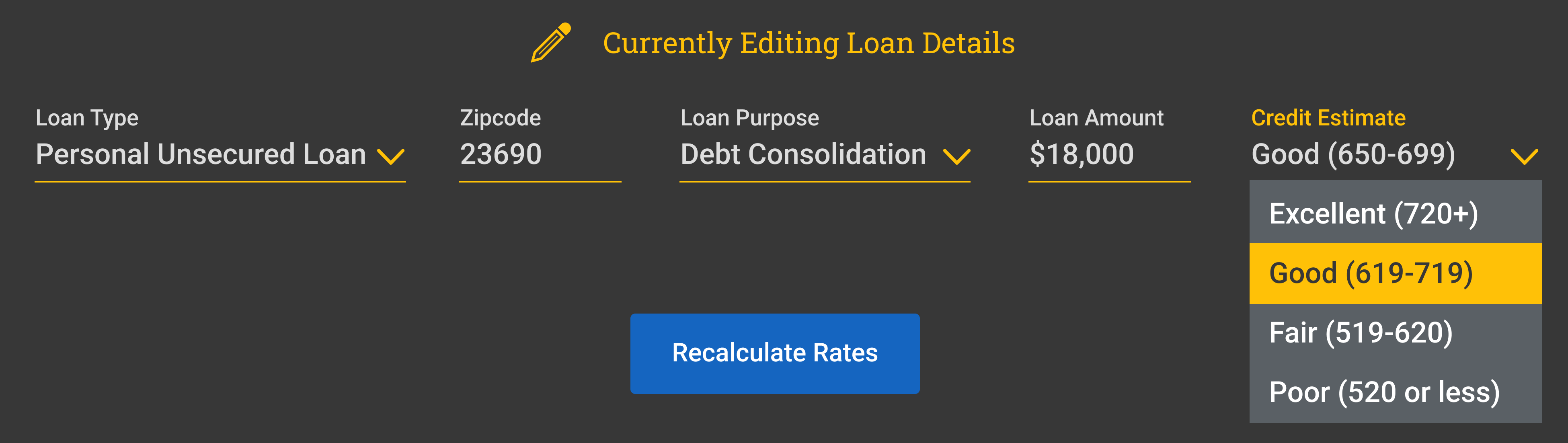

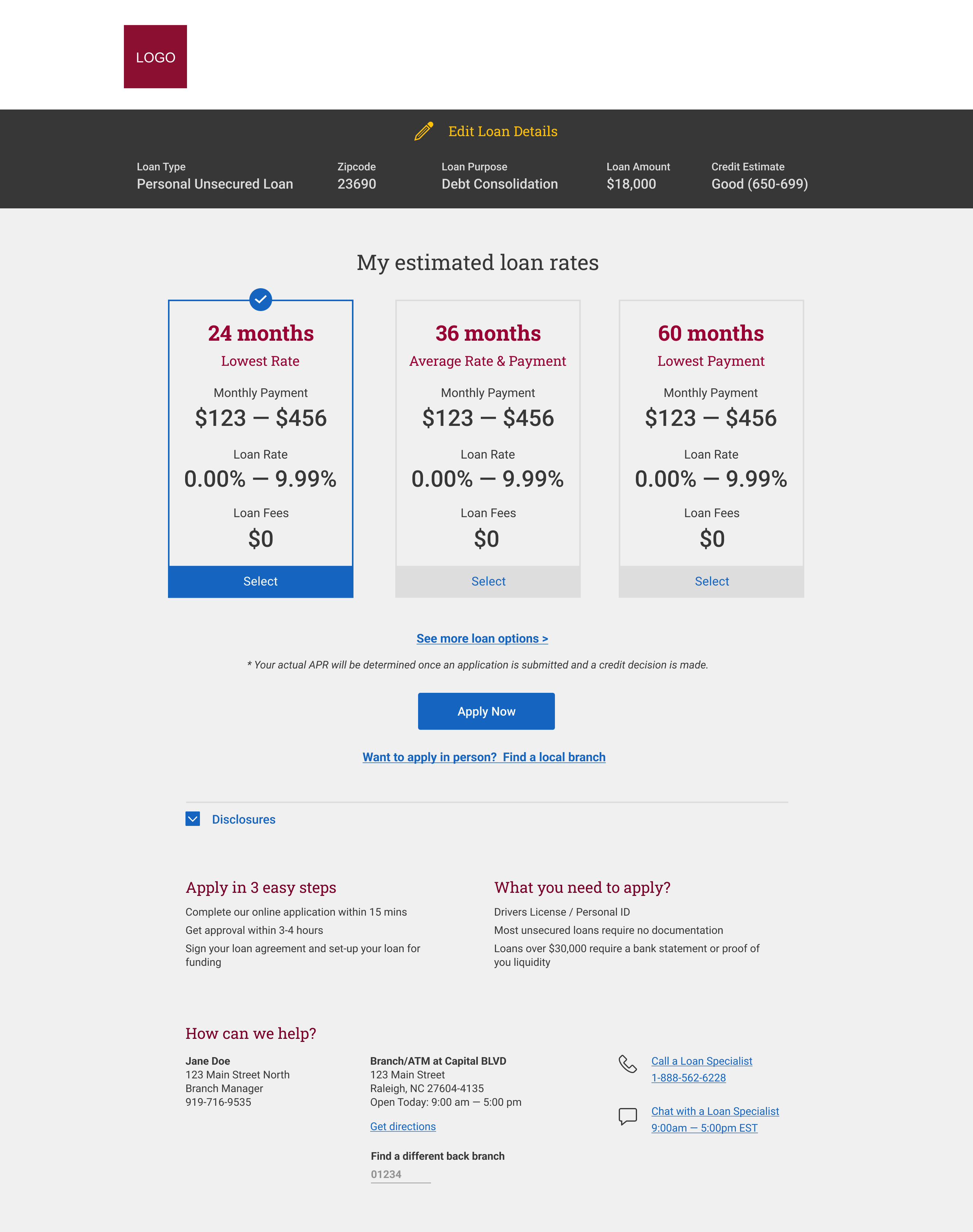

Once the customer had completed the inital questions, the website woud display the relevant loan options available based on their answers to the questions.

Those questions and their answers are available at the top of the page within the Edit Loans Details. The customer can modify there answers and recalculate the rates to view different loan options.

DESKTOP

MOBILE

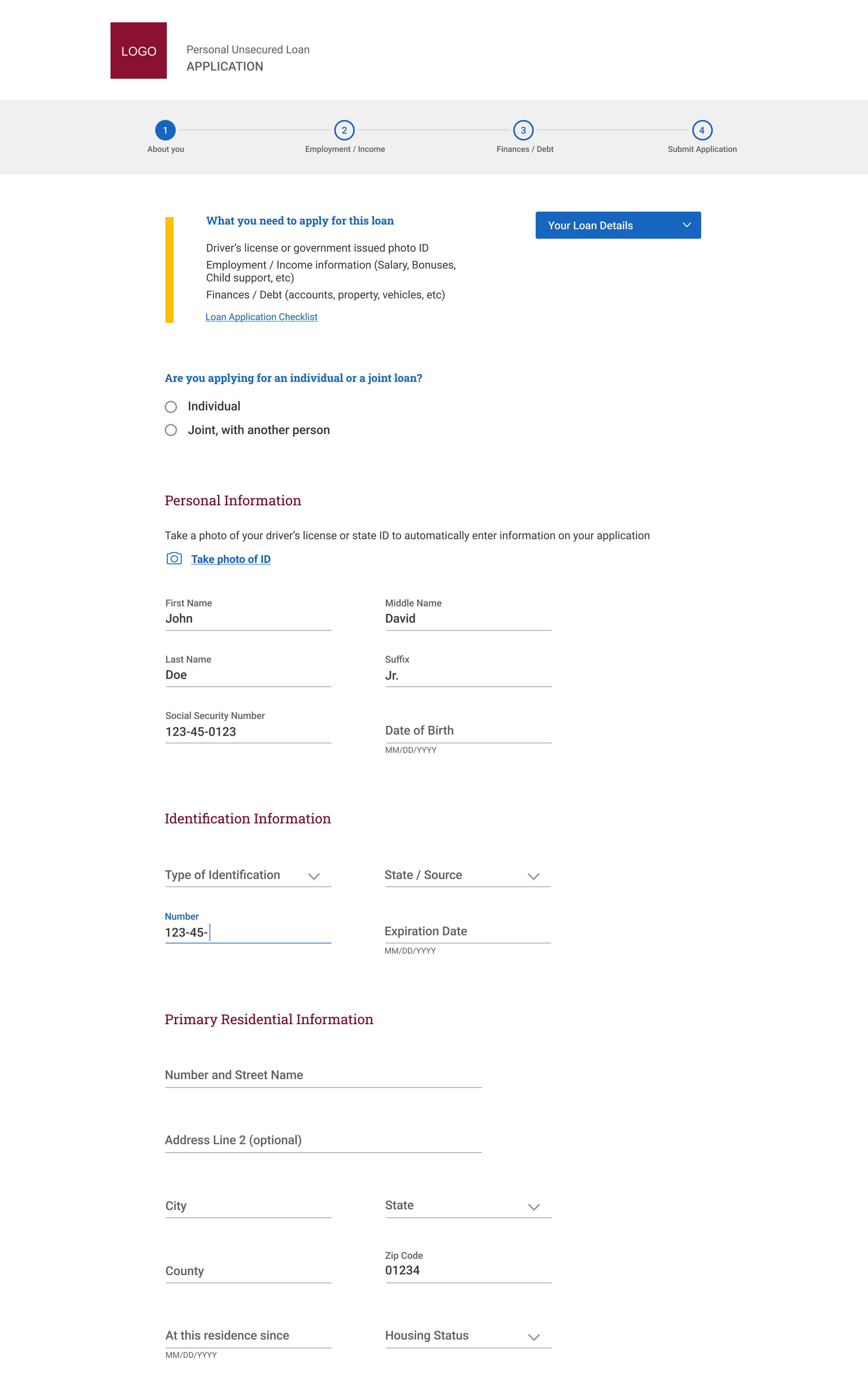

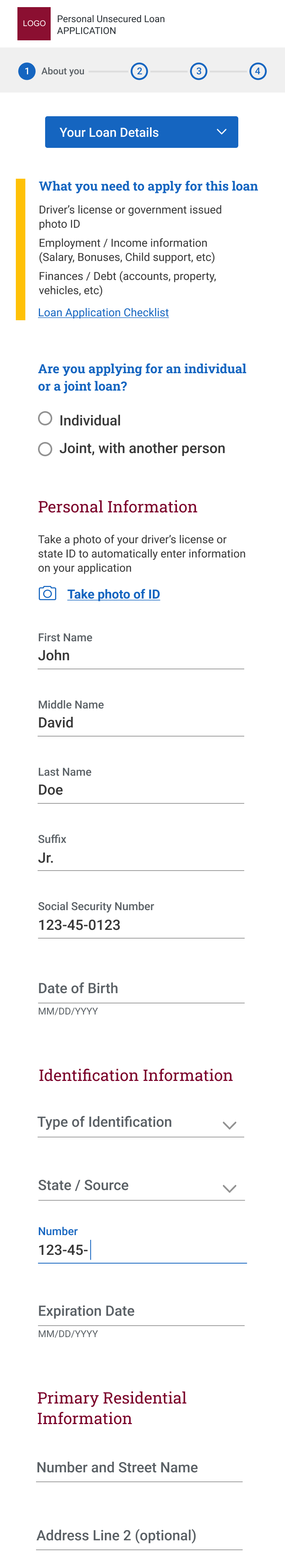

ONLINE LOAN APPLICTION

The application process is intitated after the customer has selected a loan option which meets their needs. Within the first step of the application, the customer is informed of the type of personal information needed so they can gather it before starting the application.

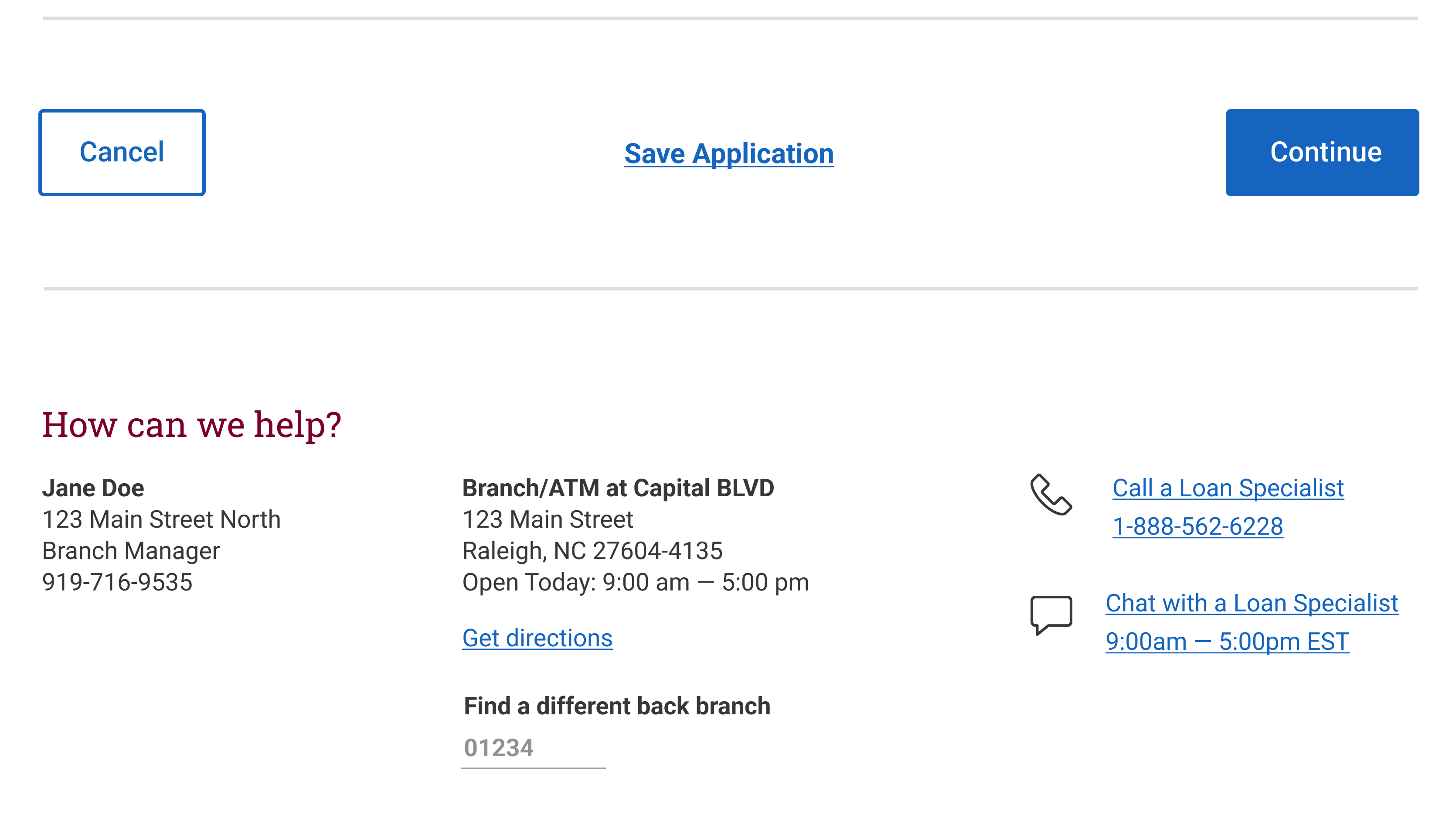

Supporting application completion

At the bottom of each step of the application process, the user has the option to save the application and comeback to complete at another time. Customers would also have options to call or chat with a loan specialist or continue the loan application in person at a local branch.

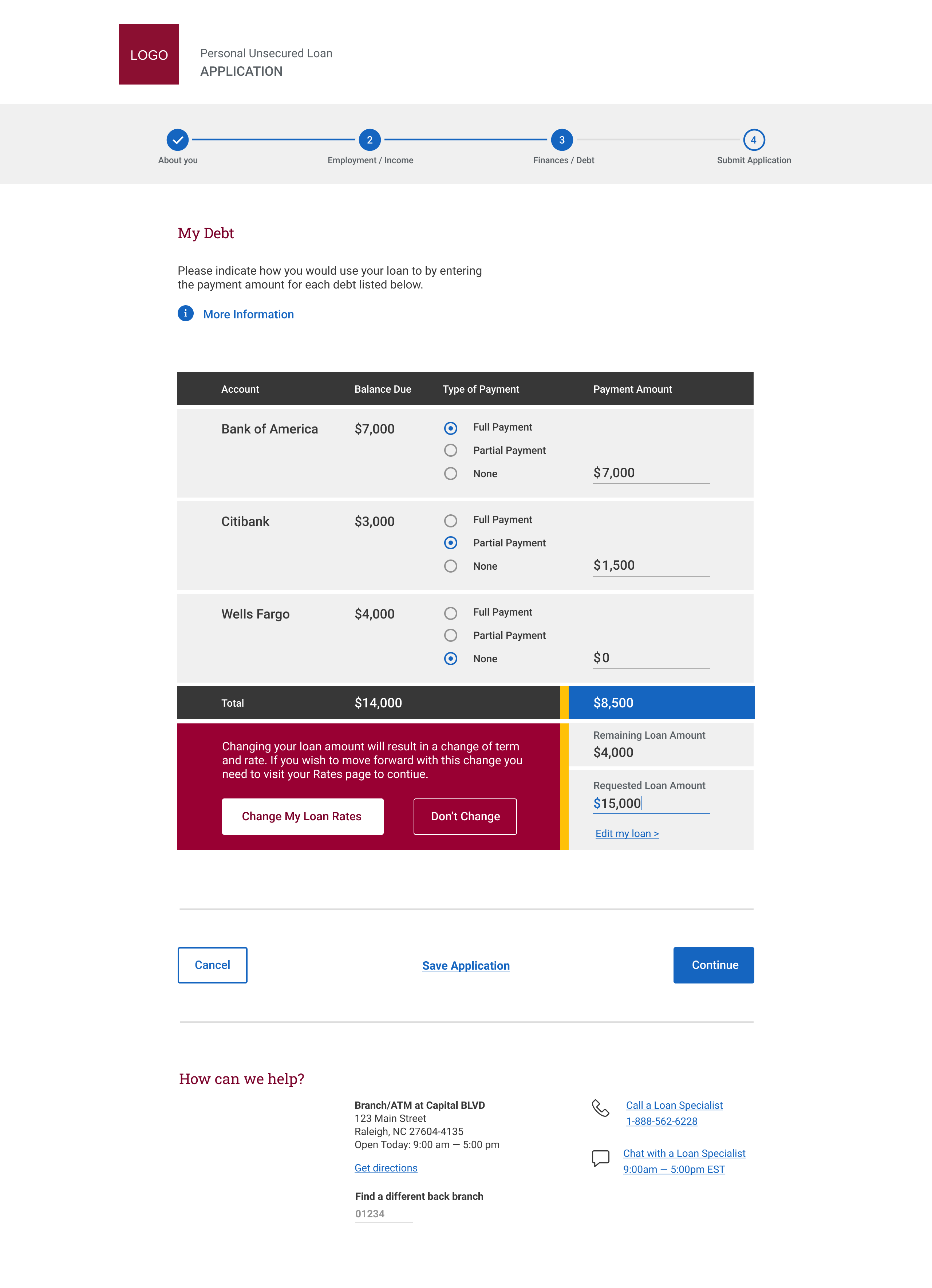

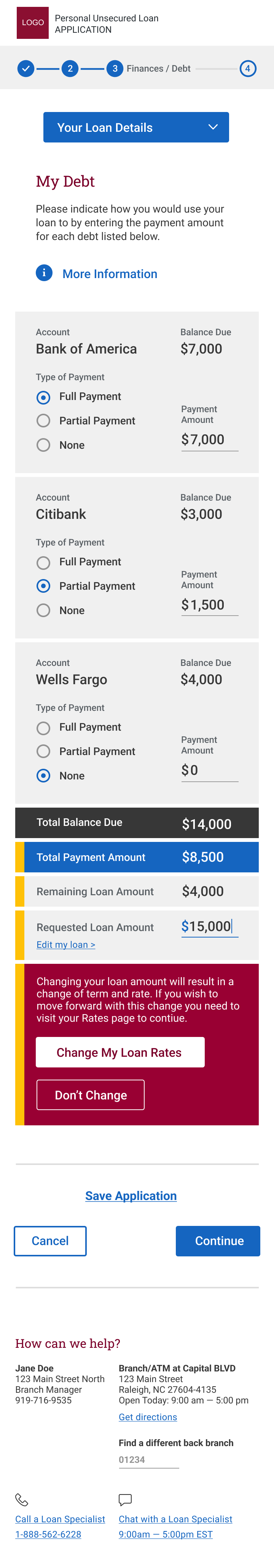

DESKTOP

MOBILE

PAYING OFF DEBT WITH YOUR LOAN

One of the key scenarios identified from our research was the need to understand how much a personal loan can help pay down existing debt. We created an online calcuator which allowed customers to enter their debt and allocate the type of payment to pay it off.

This would provide the bank with the information needed to pay off the debt on behalf of the customer and the customer would have the ability to indicate how much of their debt they want to payoff across one or more accounts.

At this point the customer can also change the type of loan they are applying for if they realize they need more or less funds to pay off their debt. This flexibility in the loan application allowed the customer to switch loans without having to enter all their personal information again.

DESKTOP

MOBILE

OUTCOMES

Defined an intuitive and simple online loan application experience which would be standardized and extended to other existing online loan apps.

Journey Maps identified constraints that were impeding the loan application process and opportunities for improvement through internal initatitves to update technology as well as back office loan processes.

Designed a responsive interface for both desktop and mobile

Established guidelines for the conversational voice and tone of the content to be more personable and contain less legalese.

Visual design explorations which were in compliance with AA accessibility had identified new design and interaction standards to be incorporated into BB&T’s existing loan app design system

Selected Works

Auto ManufacturerCX Touchpoint Journey Map + Strategy

Auto InsuranceJourney Mapping + Strategy

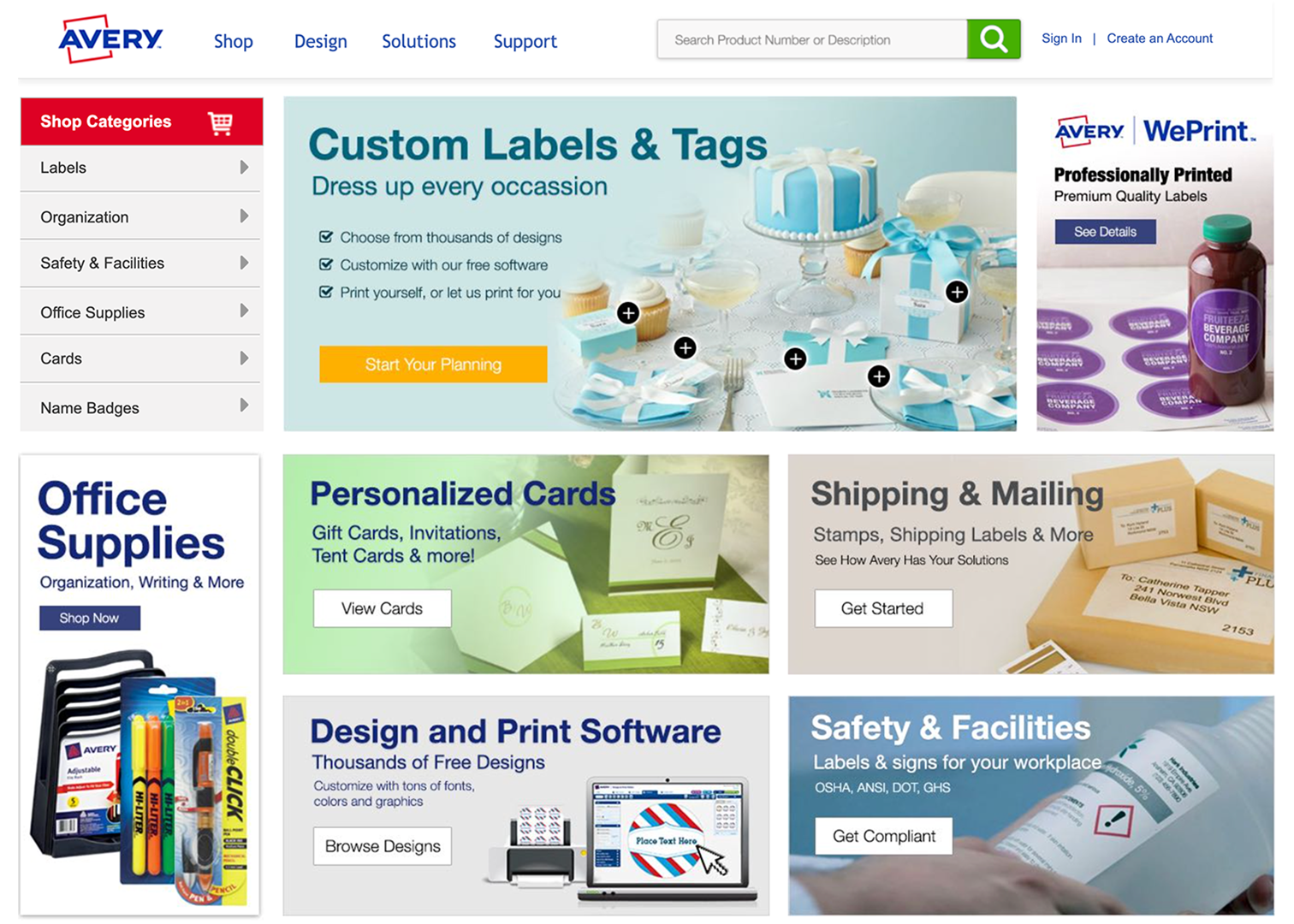

eCommerce Website RedesignResearch + Design, eCommerce

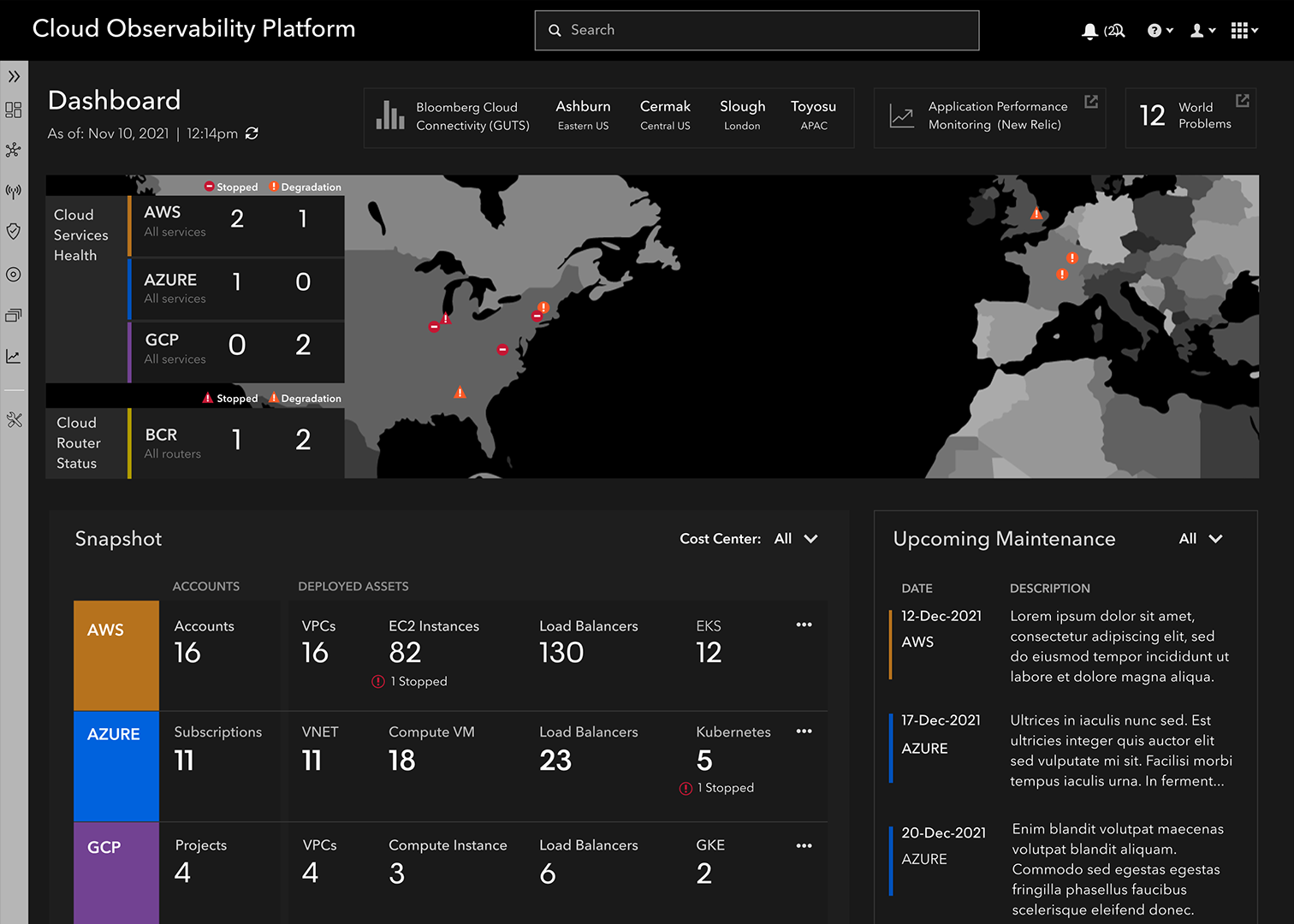

Cloud Observability PlatformResearch + Design, B2B Enterprise

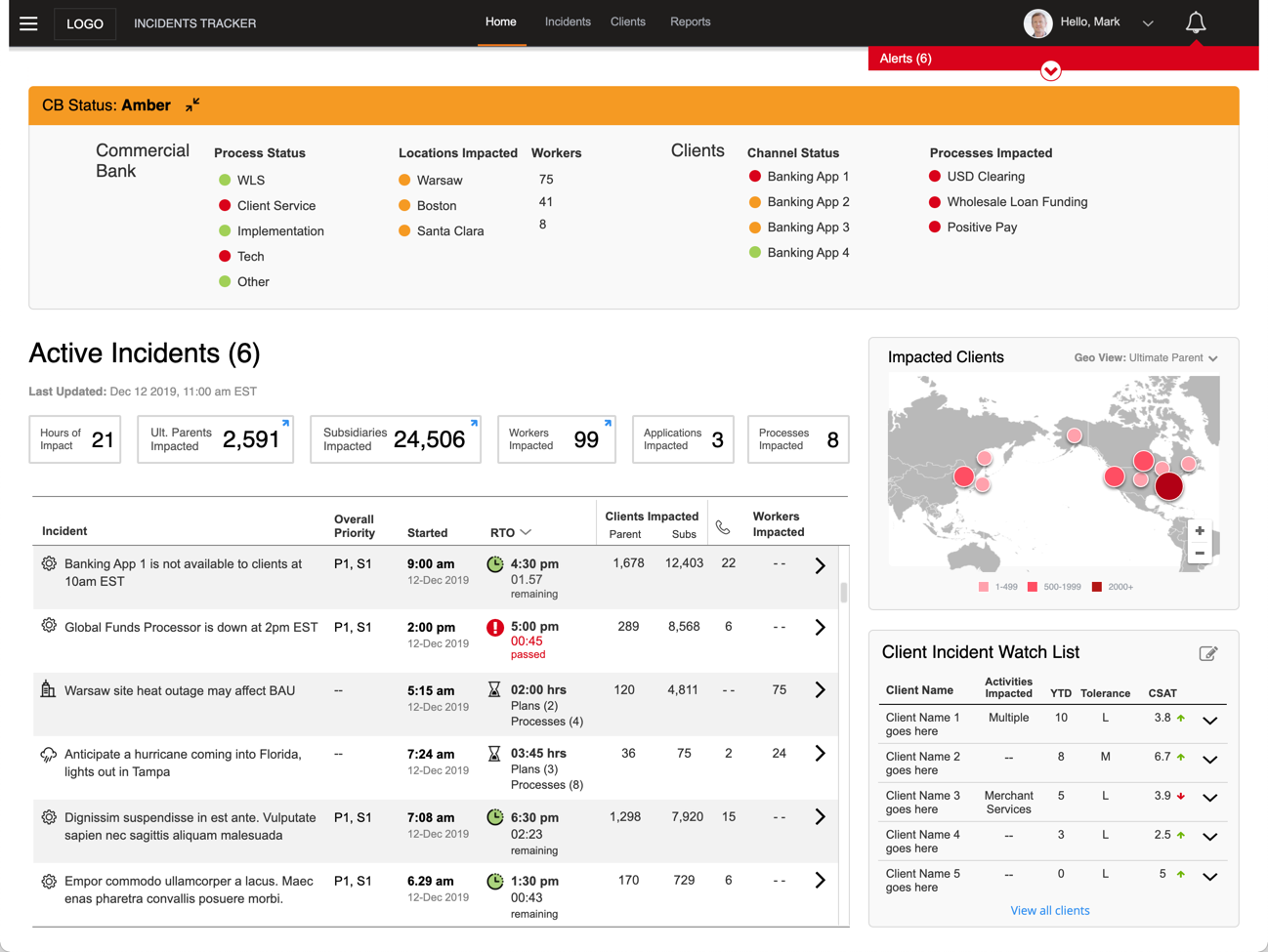

Incident Response ApplicationResearch + Design, B2B Enterprise

Investment Portfolio WorkstationResearch + Design, B2B Enterprise

Online Learning PlatformResearch and Strategy